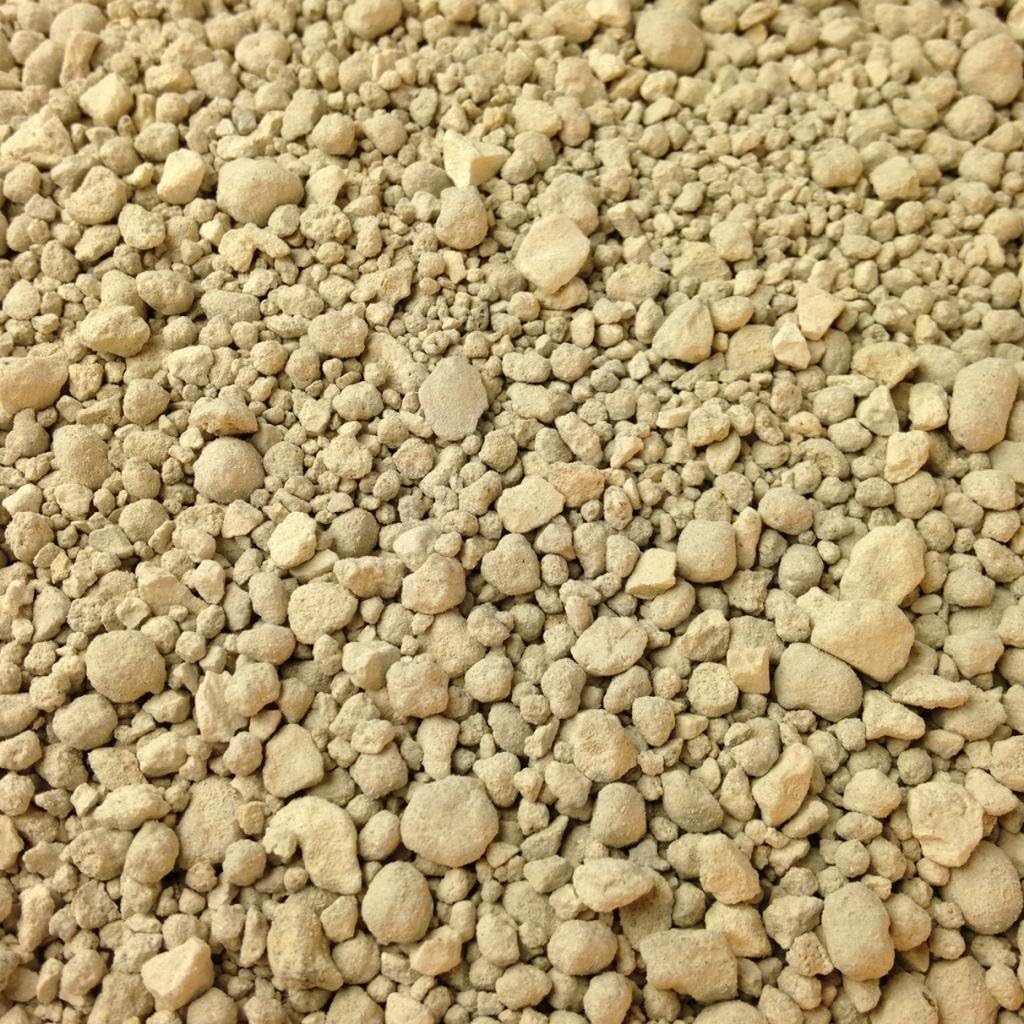

In the global fertilizer market, few commodities hold as much significance as rock phosphate. Essential for the production of agricultural fertilizers, it has become a lifeline for farmers across the world. Governments and corporations alike recognize its value, leading to intense competition whenever a new tender is announced.

One such tender was floated by a major agricultural body seeking to secure a substantial shipment of rock phosphate. Two prominent players emerged as the leading bidders: TLI Tradelink General Trading LLC, a fast-growing name in the commodity trading world, and INDAGRO SA, a seasoned multinational with decades of experience in the fertilizer industry.

The Competitive Bids

The bidding process was expected to be fierce, as both companies had a reputation for aggressively pursuing deals. When the bids were finally opened, the results were as follows:

- TLI Tradelink General Trading LLC submitted a bid of 159 USD/Ton, securing the L1 (lowest bid) position.

- INDAGRO SA came in second, with a bid of 185 USD/Ton, landing in the L2 position.

Despite INDAGRO’s vast experience and global presence, it was TLI that surprised everyone by outbidding them, offering the lowest price in the tender.

The Rise of TLI Tradelink General Trading LLC

For industry insiders, TLI’s bid represented a bold move. While TLI Tradelink had established itself as a reliable supplier of fertilizers and raw materials, this tender was its first significant foray into the rock phosphate market at this scale. Their L1 bid of 159 USD/tons positioned them as a formidable competitor, able to offer competitive pricing without compromising quality.

Behind this bid was the strategic vision of TLI’s leadership. They had anticipated the growing demand for phosphate fertilizers and made early investments in securing long-term supply chains. By leveraging strategic partnerships with key mining companies, TLI was able to offer a price lower than expected, while ensuring they could meet the tender’s demands.

INDAGRO SA’s Experience and Challenges

INDAGRO SA, on the other hand, had the advantage of experience. Known for its vast network of suppliers and clients across continents, INDAGRO had been a dominant player in the market for years. Their bid of 185 USD/Ton reflected their commitment to delivering high-quality material with a proven track record of successful projects.

However, INDAGRO’s higher bid revealed the challenges faced by larger corporations. Their global operations, while extensive, also came with higher overhead costs and a more rigid supply chain. In contrast, smaller companies like TLI had the flexibility to make quick decisions and offer lower prices, positioning them as serious contenders in a changing market.

The Outcome and Future Implications

With TLI Tradelink General Trading LLC winning the tender, they secured a pivotal contract, marking a significant milestone in their journey. For TLI, this victory meant more than just business—it was a validation of their strategy, proving that they could compete with industry giants like INDAGRO SA.

For INDAGRO, the loss was a reminder that even the most established players must constantly innovate and adapt in a highly competitive environment. They would likely analyze their bid, reassess their pricing strategy, and prepare for future tenders with an even sharper focus.