Domestic Market Reacts to Cheaper Imports

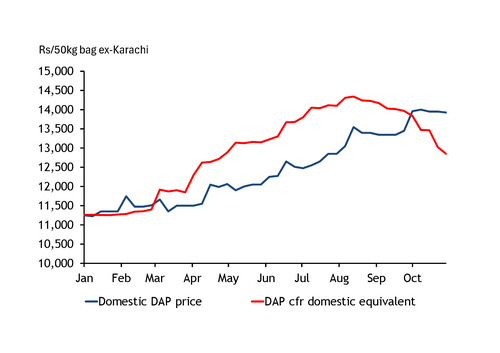

Pakistan DAP prices have started to decline after peaking in early October. The fall comes as the domestic market aligns with weakening international prices. The adjustment could pressure private importers who purchased DAP at higher cost levels, forcing some to sell at a loss.

Current domestic DAP prices range between Rs13,500 and Rs14,350 per 50kg bag ex-Karachi, according to market sources. Private importers are offering DAP at Rs13,500–13,800/50kg bag, reflecting the growing gap between landed import costs and local resale prices.

Import Costs Now Below Domestic Prices

Import prices began turning cheaper than domestic levels in early October and have continued to widen their discount. The latest DAP import assessment at $725–730/t CFR now translates to a domestic breakeven price more than Rs1,000 per 50kg bag below the Karachi market average, based on Argus data. This is the widest price gap recorded in 2025 so far.

When converting import costs into local prices, traders apply the current PKR/USD exchange rate and add roughly 14% for insurance, transport, and bagging. A 5% GST and 5% FED tax further increase landed costs. At the previous import peak of $815/t CFR in late August, breakeven landed costs stood at Rs14,341 per 50kg bag.

Delayed Price Alignment and Loss Risks

Domestic DAP prices have typically followed import trends with a two-month lag. Import prices overtook domestic levels in March, maintaining a premium of about Rs1,000/50kg bag through May to August. Importers expected domestic prices to rise further to protect their margins.

However, local prices never matched the import peak seen in August. Instead, they reached a midpoint high of Rs14,000/50kg bag in mid-October, equal to about $793/t CFR at the latest exchange rate. Any imports priced higher than this level now risk losses in the domestic market.

Suppliers Balance Inventories Amid Price Pressure

Industry participants expect domestic prices to fall faster than international levels in the weeks ahead. Suppliers will try to limit further reductions to preserve earlier gains from high-priced imports.

Yet farmers entering the peak buying season in November are pointing to the bearish global trend and asking for price relief. The cancellation of an expected DAP subsidy has tightened farm budgets, even as crop prices improve.

Suppliers reportedly hold ample inventories, and some are eager to offload stock to avoid deeper losses if the market continues to weaken.

Import Volumes and Outlook

Private importers have brought an estimated 440,000 tonnes of DAP into Pakistan since May, according to port lineup data. Some buyers are now targeting fresh imports near $700/t CFR, a price not seen since mid-April. At that level, breakeven landed costs would equal roughly Rs12,361 per 50kg bag ex-Karachi.

If domestic DAP prices drop another 9–10%, importers who bought cargoes after mid-April could face financial losses.

Branded and locally produced DAP, which typically sells at a premium, is less exposed to immediate losses. However, Pakistan’s domestic producers are under pressure as higher raw material costs continue to squeeze margins.