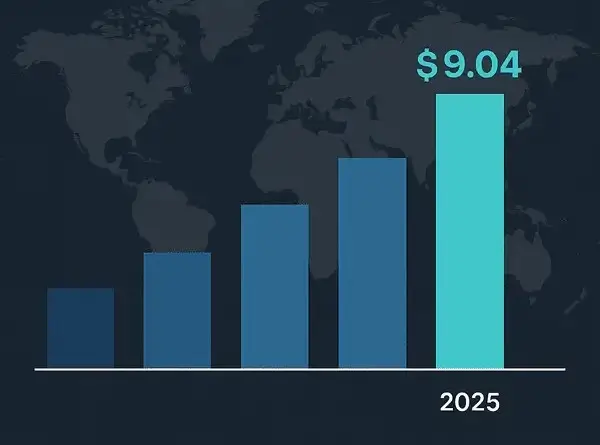

The OCP Group Revenues 2025 report shows a powerful surge in performance. During the first nine months of 2025, the Moroccan phosphate giant generated $9.04 billion in revenues, up from $6.95 billion in the same period last year. This sharp rise highlights OCP’s ability to capture growing global demand for phosphate-based products and supply new regional markets with ease.

According to the company, the strong performance was driven mainly by higher export volumes of phosphate rock and fertilizers. Global demand remained firm throughout the year, and OCP successfully met rising needs across multiple regions.

Fertilizer Sales Accelerate With Higher Export Volumes

Fertilizer revenues increased 17% year-on-year in local currency. The growth came from stronger export volumes and expanding market demand. Moreover, TSP (Triple Superphosphate) volumes jumped 55%, accounting for 30% of OCP’s total fertilizer export sales. India, Brazil, and key African markets delivered the strongest buying momentum.

This growth reinforces OCP’s strategy of supplying agronomically efficient fertilizers that boost soil health and improve crop productivity. As TSP demand continues to rise, OCP is strengthening its role as a major supplier in this segment.

Phosphate Rock Revenues Double

Phosphate rock revenues recorded an impressive 112% increase in local currency. The jump came from robust export volumes and strong market appetite for raw phosphate materials.

However, phosphoric acid revenues declined 10% year-on-year due to lower sales volumes. The company also shifted more material toward downstream fertilizer production to meet expanding market needs.

Specialty Products & Solutions Drives Growth

OCP’s Strategic Business Unit – Specialty Products & Solutions (SPS) continued its upward trajectory. Export revenues reached $647 million during the first nine months of 2025. Higher volumes of specialty acids, water-soluble fertilizers, and feed phosphates supported this growth.

SPS remains a key growth engine within OCP, offering high-value products tailored to modern agricultural requirements.

Profitability Strengthens Despite Higher Raw Material Costs

Gross profit increased to $5.77 billion, up from $4.48 billion last year. The improvement came from strong revenue growth and better cost management across the value chain. This progress was achieved even with elevated ammonia and sulfur prices.

Year-to-date EBITDA rose to $3.31 billion, compared with $2.72 billion a year earlier. With an EBITDA margin of 37%, OCP demonstrated strong operating momentum and consistent efficiency gains. The flexibility of its integrated production platform also helped the company respond quickly to market shifts.

Conclusion

Overall, the OCP Group Revenues 2025 performance highlights the company’s strong global position and its ability to adapt to evolving market trends. With solid demand for fertilizers, growing TSP markets, and rising specialty product sales, OCP is well-positioned for continued growth in the coming years.